Overview

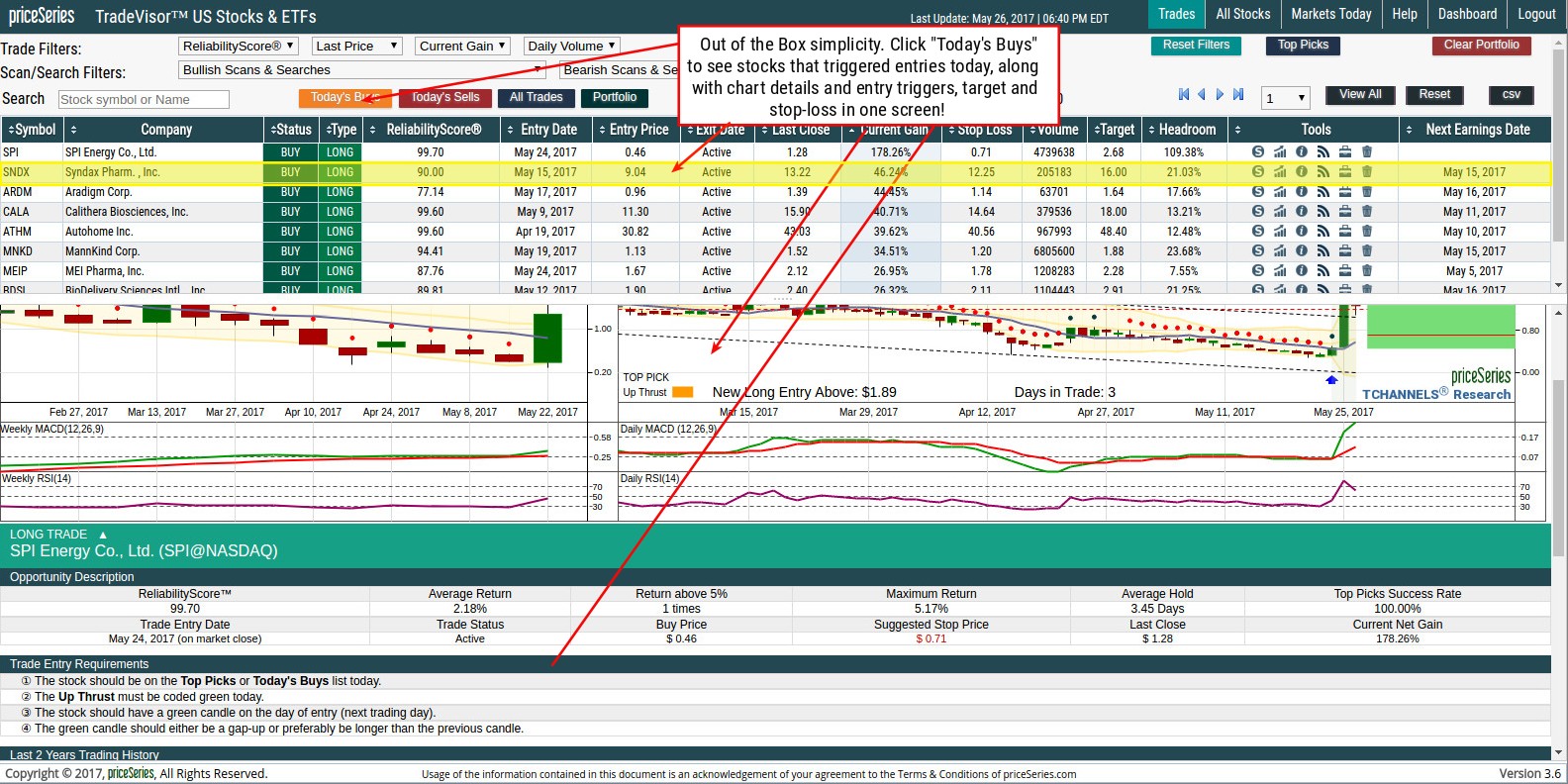

TradeVisor™ is a powerful subscription-based algorithmic stock research and portfolio management platform available at priceseries.com. Founded by Rajesh Srivastava, an engineer and trader with over 25 years experience in Silicon Valley serving at firms ranging from Hewlett Packard, Symantec, and Intel Security/McAfee has applied his extensive technical background in developing this algorithmic platform. Sophisticated machine intelligence algorithms scour US equities markets to identify, monitor and track the best stocks to trade. For most traders it is simple enough to understand right “out of the box”. The training videos take about 15-minutes to acclimate to the platform. TradeVisor provides analytics and adjustable parameters to help narrow the filtering to meet specific criteria. This is an end-of-day product that updates alerts after the market close by 7 pm EST. This is great for swing traders as well as day traders looking for set-ups to play the next day.

Power and Simplicity

Power and Simplicity

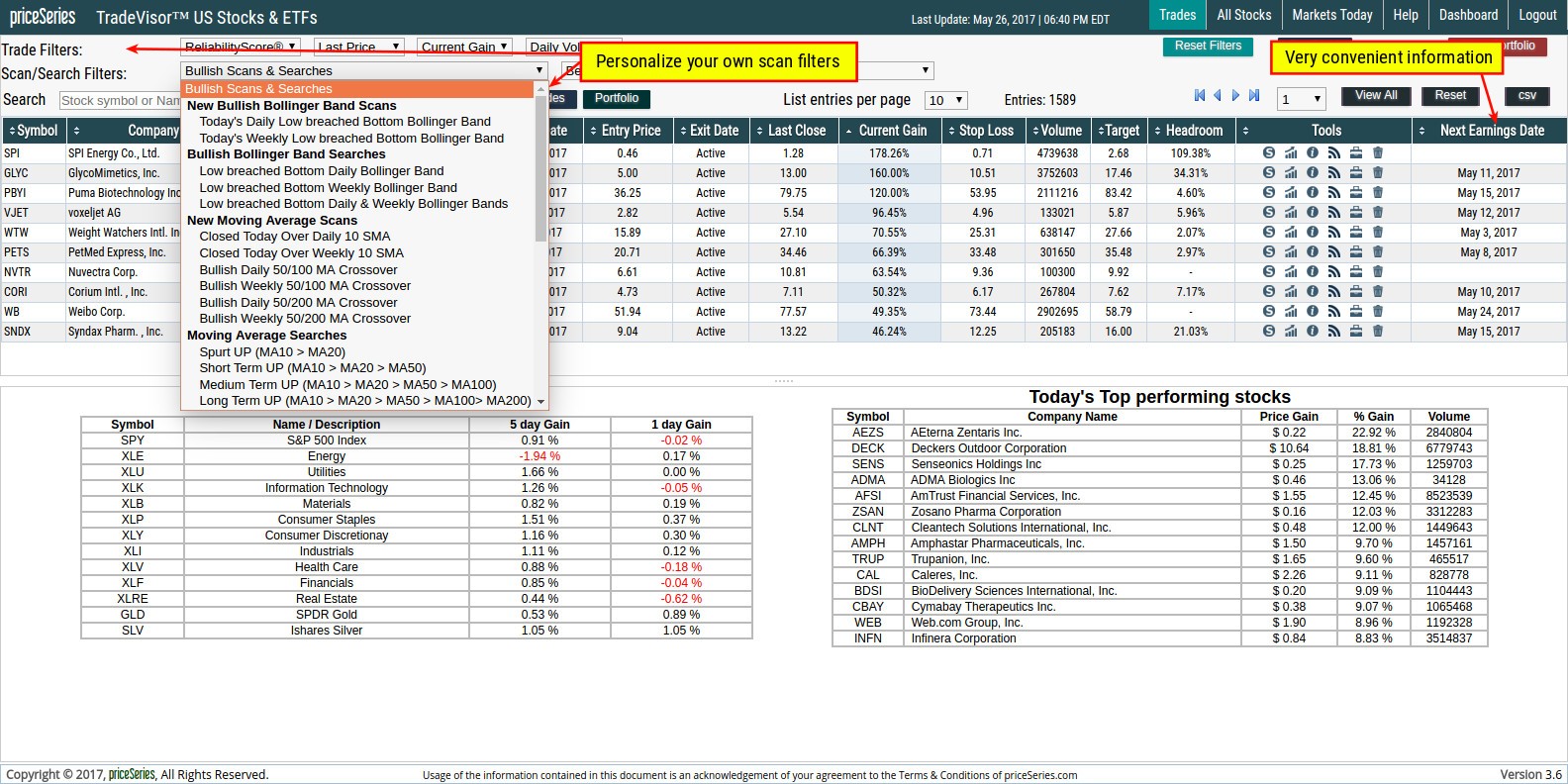

The front-end simplicity powered by robust search and analytic algorithms under the hood make this an excellent stock selection platform for traders and investors alike. I like how it puts the alerts out there with suggested buy, sell and stop price levels. Unlike other platforms on the market that are ambiguous and require users to learn an extensive list of terms and convoluted ratios, this platform is direct and cuts out the fluff. I like that. It is simple enough for anyone to log into this web-based platform and immediate understand the alerts and follow the in-trade stocks, or consider the new trade alerts for that day. The alerts can be clicked and sorted by categories.

Subscribe by Email

Follow Updates Articles from This Blog via Email

No Comments